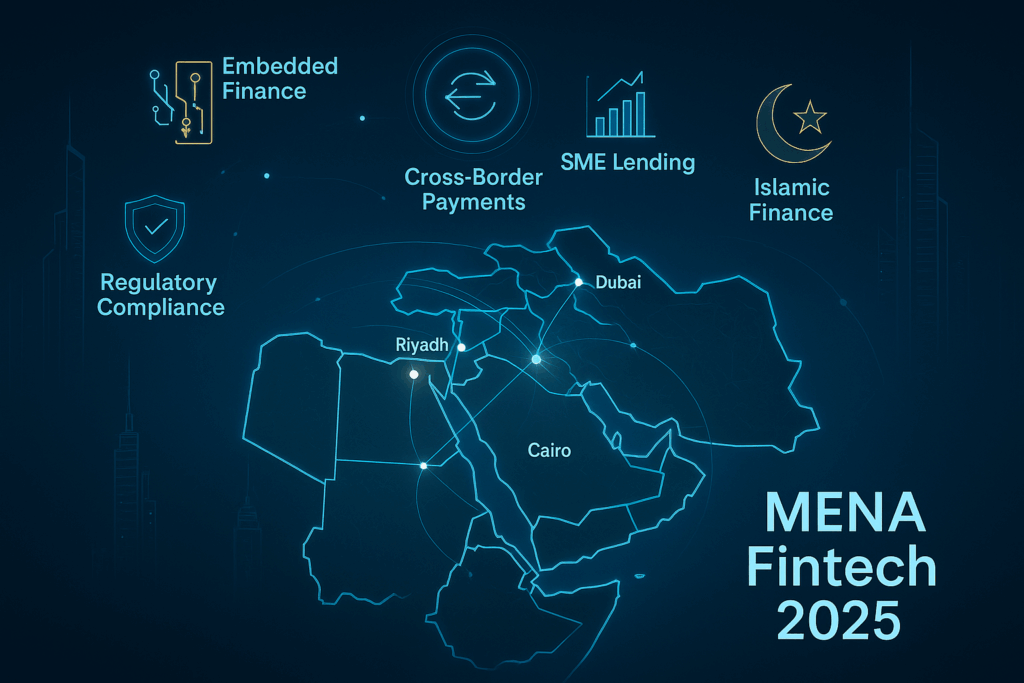

The MENA region’s fintech sector is entering a pivotal phase as regulatory clarity, digital adoption and market demand converge to reshape financial services. Five key trends stand out:

- Embedded finance is moving mainstream with APIs enabling seamless payments, lending and insurance within commerce platforms, creating a projected USD 12 billion market by 2027.

- Cross-border payments are being transformed through regulatory reforms and blockchain rails, slashing remittance costs and settlement times across key corridors.

- SME lending is rebounding as artificial intelligence (AI)-driven underwriting and alternative data unlock credit for underserved businesses, addressing a USD 240 billion financing gap.

- Islamic finance is shifting from compliance to innovation with digital sukuk, robo-advisors and automated zakat platforms.

- RegTech is emerging as the fastest-growing vertical, with automated compliance now a survival requirement.

Across the United Arab Emirates (UAE), Saudi Arabia and Egypt, fintechs that master execution, profitability and regulatory discipline (rather than just chasing hype) will capture the greatest opportunities. The next decade will be defined not by disruption, but by sustainable growth and operational excellence.